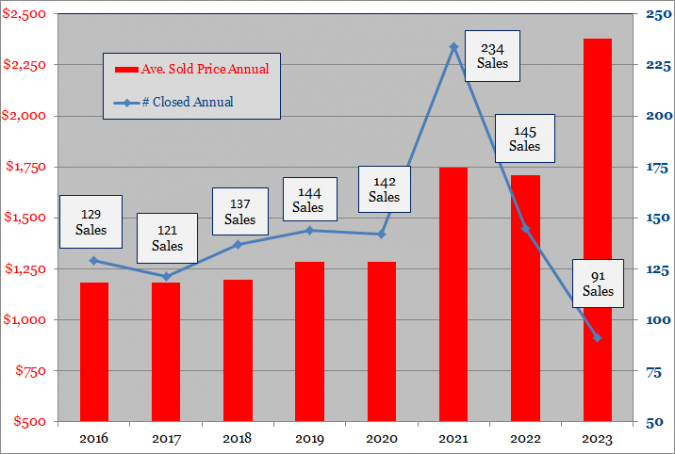

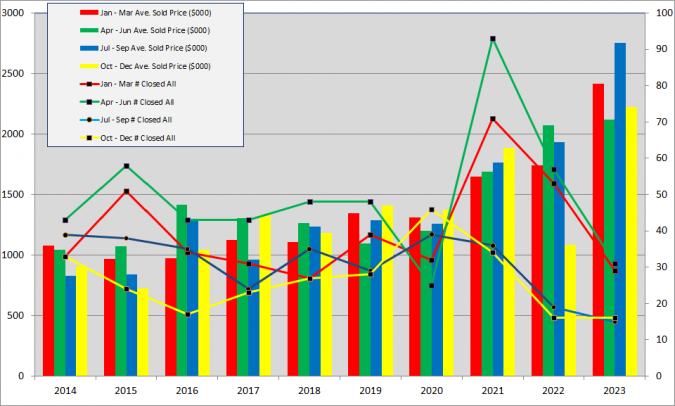

Five single family homes sold in the Old Town Key West area in December bringing the total number of homes sold in 2023 to 91. Ninety-one is the fewest number of homes sold in the Old Town Key West area since 2009. Ninety-one is 42% below the 5-year (2018-2022) average number of homes sold in a year, 37% below all of 2022, 61% below all of 2021 and 36% below all of 2020. On Prices, the five sales in December had an average sold price of $2.1M. This brings the average sold price for 2023 to $2.38M or 39% above 2022. The average sold price per square foot for 2023 was $1278, up 9% over 2022 and 31% over 2021. Both average sold price and average sold price per sqft are record highs.

________________________________________________________________________________________

The below charts show sales of the seven most popular bed/bath combinations in Old Town Key West from January 1, 2014 to December 31, 2023. When there is a difference between total home sales and the sum of sales in the below seven charts it is because of a sale of, for instance, a 2bed/3bath or 3bed/1bath house or a house with more than four bedrooms.

These charts are for single family homes sold south and west of White St. and cover the six neighborhoods of The Meadows, Old Town North and South, Bahama Village, Truman Annex and Casa Marina but not Sunset Key. You can view a map of the six neighborhoods of Old Town here. An analysis of the number of sales and sale prices for each of these six neighborhoods for the full year of 2023 is here.

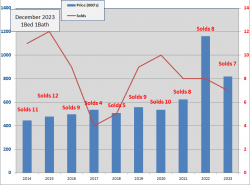

1 Bedroom/1 Bathroom

- Seven,1Bed/1Bath homes have sold in the Old Town area thru 12/31/2023. Average days on market was 24 days. For all 2022, eight homes sold at an average number of days to sell of 60 days.

- The average Sold price for the seven 2023 sales is $817K which is down 30% from 2022 yet 319% above the 2011 low. In 2022, the average sale price for the 8 sales was $1.16M, highest ever.

- There are two 1/1's for sale priced at $799K and $1.375M

- The 2023 sales have an average size of 603 sqft at $1356 per sqft. In 2022, the average size was 789 sq.ft. and the average sale price per sqft. of $1471 was highest ever.

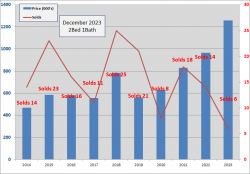

2 Bedrooms/1 Bathroom

- Six, 2Bed/1Bath homes have sold in the Old Town area thru 12/31/2023 in an average of 88 days to sell. For all 2022, fourteen homes sold at an average of 42 days to sell.

- The 2023 average sold price of $1.258M is up 30% over 2022 and 279% above the 2011 low.

- The sold price per square foot in 2023 of $1252 is up 16% over 2022 and is the highest ever.

- There are seven 2/1 homes for sale priced between $750K and $1.398M.

- Since 2009, 2Bed/1Bath homes have been the 3rd most popular selling home in Old Town with 249 sales

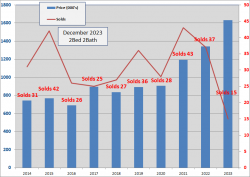

2 Bedrooms/2 Bathrooms

- Fifteen, 2Bed/2Bath homes have sold in the Old Town area thru 12/31/2023 with an average of 46 days on market. For all 2022, thirty-seven homes sold at an average of 45 days to sell.

- The 2023 average Sold price of $1.63M is up 22% over 2022 and 284% above the low in 2009.

- Thirteen 2/2's are for sale, priced between $925K and $4M.

- The 2023 average Sold price per sqft of $1289 is up 17% over 2022.

- Since 2009, 2Bed/2Bath homes have been the biggest sellers in Old Town Key West with 444 sold.

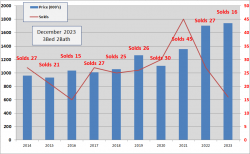

3 Bedrooms/2 Bathrooms

- Sixteen, 3Bed/2Bath homes have sold in the Old Town area thru 12/31/2023. The average number of Days to sell is 80 Days.

- The average Sold price of $1.742M is up 2% from 2022 and is 278% above the 2009 low.

- The average sold price per sqft. is $1145, identical to 2022.

- Twenty-seven 3/2 homes sold in 2022, 3rd most ever.

- Since 2009, 3Bed/2Bath homes have been the 2nd biggest sellers in Old Town, exceeding twenty sales every year since 2013 except in 2016. Total sales since 2009 is 349 sales.

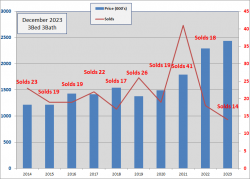

3 Bedrooms/3 Bathrooms

- Fourteen, 3Bed/3Bath homes have sold in the Old Town area thru 12/31/2023 at an average of 110 Days to sell. For all 2022, 18 homes sold at an average of 40 Days, fastest ever.

- The 2023 average sold price of $2.44M is up 6% from 2022 and 231% above the 2010 low.

- The average Sold price per sqft. of $1426 is up 17% over 2022.

- Forty-one homes sold in 2021, nineteen homes sold in 2020.

- Since 2009, 3Bed/3Bath homes have been the fourth biggest seller in Old Town Key West with 291 sales

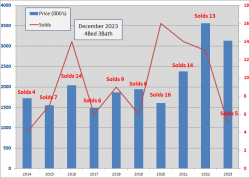

4 Bedrooms/3 Bathrooms

- Five, 4bed/3bath homes have sold in the Old Town area thru 12/31/2023 at an average of 40 Days to sell. For all 2022, 13 homes sold at an average of 66 days to sell.

- The 2023 average sold price of $3.135M is down 12% from 2022 and is 271% above the 2009 low.

- The 2023 average sales price per sq.ft. of $2210 is up 56% over 2022, easily highest ever for a 4/3 home.

- There are twelve 4/3 homes for sale priced between $2.3M and $5.9M.

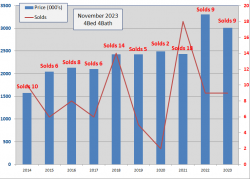

4 Bedrooms/4 Bathrooms

- Nine, 4Bed/4Bath homes have sold in the Old Town area thru 12/31/2023 at an average of 39 days to sell. For all 2022, nine homes sold at an average 49 days.

- The 2023 average sold price of $3.009M is down 9% from 2022 and is up 170% over the 2009 low.

- The 2023 average sold price per sq.ft. of $1095 is down 15% from 2022.

- Since 2003, the average number of annual sales is six, with nine in 2022, eighteen in 2021 and two in 2020.

- Despite the choppy number of sales, price action has steadily climbed from $2.M in 2015 to $3.3M in 2022.

Summary

Cash sales dominated the 2023 market at 69% of all sales and encompassed the entire price range of sales from below $500K to the multi-millions. Historically, cash sales in Old Town Key West have averaged 50%-52% of total sales which itself is twice the national average. Since 2019, the number of cash sales has actually remained steady, it's total sales and mortgage purchases that have both declined significantly.

Inventory in 2022 was lousy, averaging 31 homes for sale per month. Inventory in 2023 rebounded, averaging 59 homes for sale per month. After a sluggish 2023 summer, inventory in October jumped to 64 homes for sale and as of December 31st, inventory was 79 homes for sale. Prior to 2019 the number of homes on market averaged 120 per month in winter/spring and 90 per month in summer/fall.

I looked at the ownership of all 79 of the homes presently for sale. Of these, 27 were purchased during the Covid rebound period of July 2020 to August 2022 and 78% of these 27 buyers (21 homes) kept their primary residence as NOT Key West. These Covid period, reasonably affluent buyers escaped to Key West, invested in their purchases and are now leaving Key West. Why? Is it just for the money or is something turning them away from Key West because flipping in Old Town has not been a significant trend since the very early 2000's.

Conclusion

The average markup of the 27 Covid homes for sale is 69%. Some of these 27 homes have been improved during their brief period of ownership and the rate of appreciation of the property plus any rents being received could be triggering the sale. Most likely, the strategy of the 78% who maintained their primary address outside of Key West was to use Key West as a temporary shelter. Still, this many "flips" begs the question - why?

Could this many flippers have anything to do with Key West itself? Have these affluent buyers-now-sellers evaluated Key West and decided that an early divorce is for the best? What could they have found lacking in the Southernmost City and could an informal Exit Interview of them help Key West gain some perspective in how to improve quality of life for all Key Westers. What if -

Growth, productivity and societal health and wealth are the result of Innovation + Capital + People - where Innovation and technological progress carry the greatest weighted impact.

People - Education choice in Key West has increased significantly over the past 5 years in grades pre-K through 12 and the College of the Florida Keys has moved well past that of a community college (the Nursing program is Excellent). Yet, public sector hiring; government, utilities, police and fire, generally follows a Bubba hiring process which can result in brain drain away from Key West. Key West's private sector struggles to find qualifed workers across all skill sets yet workers have little pricing power. The primary industry in Key West, tourism, does not steer towards high wages and another large employer, private sector construction, while understaffed in all skill areas, must still price contracts competitively.

Capital - The governments of Monroe County and Key West are awash with money. Tourist dollars, rent revenue and property taxes on out of area property owners are major and reliable contributors to their money pots. To their credit, both governments spend prudently, have excellent credit ratings (Monroe County, Key West**) and both are solvent to all of their liabilities. The City of Key West reports it costs $165,000 +/- per day to run the city. By mid 2024, the City projects 100 days in Reserve. The Reserve allows for the running of the government, police and fire but provides little benefit to Key West's private sector. Tourism in Key West is dominated by locally owned small businesses (who pay enormous rents) with limited access to big capital infusion and the "Big box" tourism entities that are in Key West send most of their revenue off island (without providing workforce housing).

** I could not find a credit rating for Key West. Instead I provided the latest end of year financial report which is for 2022. End of year 2023 finances will be reported in Spring 2024.

Innovation - I can point to only two significant technological upgrades in Key West; the ongoing expansion of the Key West International Airport and Keys Energy which has a state-of-the-art Command Center at their Key West HQ, through which they can view and control every substation in their network in real time. Otherwise, there are virtually zero Green upgrades either government or private, the three major shopping centers retain their inefficient 1960s, single story retail/grocery store and parking lot sprawl and the ongoing 20 year, $2B upgrade to the county's fresh water infrastructure disregarded any advanced fresh water technologies. What little new residential construction there is, is traditional "on-site" construction, County Health services and their efforts to control wide spread societal, drug and alcohol abuse receives a scant .47% of the county budget and the near total lack of publc transportation compels many Key West workers to drive 30 - 45+ minutes each morning to work and evening to home. (Many hotel workers live in Homestead, FL and commute 3 hours each way!)

The brightest star of innovation in Monroe County and Key West involves the Florida Keys National Mariine Sanctuary and the determined and multiple-entity efforts to save the coral reef by transplanting coral. Marine biotech and related education and technology is a high value, global enterprise the transfer of which could really "take root" in the Keys.

With few solutions in sight to resolve these constraining problems and limited investment by Covid buyers in Key West itself, maybe its not so odd for Covid buyers to take the money and run.

The best news is - No storms since 2017! Thank you Sister Louis Gabriel.

If you have any comments or questions, please contact me here.

Welcome to 2024. Good luck.

Additional Sources: