Did you know that you can receive up to a 20% federal income tax credit for the rehabilitation of an historic property? The rehabilitation credit – under Internal Revenue Code (IRC) Section 47 – is also commonly referred to as the historic preservation or historic tax credit and provides a tax incentive to rehabilitate historic buildings. If your rehabilitation and expenses qualify, you may claim a tax credit equal to 20% of your qualified expenses. The credit is allocated ratably over a 5-year period on your federal income tax return. The National Park Service can also provide guidance and technical information regarding sustainability and energy efficiency for the rehab.

________________________________________________________________________________________

The Federal Historic PreservationTax Incentives program encourages private sector investment in the rehabilitation and re-use of historic buildings and is one of the nation's most successful and cost-effective community revitalization programs. Since 1976, the program has leveraged $131.7B in private investment to preserve more than 49,000 historic properties. This Historic Rehabilitation Tax Credit (HRTC) is jointly administered by the Internal Revenue Service (IRS) and the National Park Service (NPS) in partnership with State Historic Preservation Offices (SHPO).

The Florida SHPO is the Division of Historical Resources.

The 2023 annual report on the impact of Federal Historic Tax Credits is shown here. In Fiscal Year 2023, estimated rehabilitation costs totaled $9.49 billion for preliminary certifications and $8.81 billion for final certifications.

One thing to know from the beginning - the 20% Historic Rehabilitation Tax Credit is available only to properties rehabilitated for income-producing purposes; that is, commercial, industrial, agricultural, rental residential or apartment use. The credit cannot be used to rehabilitate your private residence.

However, if a portion of a personal residence is used for business, such as an office or a rental apartment, in some instances the amount of rehabilitation costs spent on that portion of the residence may be eligible for the credit.

Also, there is flexibility regarding the period of time after the rehabilitation is complete and the property has been depreciated. Factor #4 of Eligibility Requirements states that after the rehab is complete the property must be depreciable for at least five years. OK, after 5 years, then what?

Eligibility Requirements

There are four primary Factors that determine if your rehabilitation project meets the basic requirements for the 20% tax credit. They are:

- The historic building must be listed in the National Register of Historic Places or be certified as contributing to the significance of a "registered historic district" AND it must be designated by the National Park Service as a structure that retains historic integrity and contributes to the historic character of the district,

- The project must meet the "substantial rehabilitation test"; that is, the cost of rehabilitation must exceed the pre-rehabilitation cost of the building. Generally, the period of rehab must be within two years to five years.

- The rehabilitation work must be done according to the ten principles that comprise Secretary of the Interior's Standards for Rehabilitation.

- After rehabilitation, the historic building must be depreciable, such as in a business, commercial or other income-producing use, for at least five years.

Five years is referred to as the "recapture period" and is the minimum period of time that the rehabbed property must be used as a depreciatable property in order for the investor to receive the full federal tax credit.

I spoke with an IRS agent recommended by the Florida SHFO about whether or not a building rehabbed and used as rental residential or apartment use could revert to personal residential use after the 5 year recapture period had expired. I was given a definite no worries. After the 5-year recapture period is over, the owner of the property can use the property as they please. So, rehab an historic property into rental residential or apartment use and after the 5 years, take over the property for your own personal residence!

There are six more secondary eligibility items regarding; buildings not structures, physical integrity, non-historic surface coverings, multiple buildings, moved buildings and demolition that are discussed here.

What's next? What's first?

Is the property you are interested in rehabilitating an historic property? Two ways to find out:

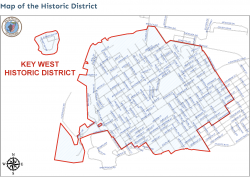

- The most official and least ambigious method is to contact the Florida Master Site File office. Email: sitefile@dos.myflorida.com. Phone: 850.245.6440. I emailed this office asking if my property, 824 White St., was designated an historic site. In less than 24 hours, I received an email reply stating that my property "is a contributing resource to the National Register listed Key West Historic district (MO1976)." I also received a Site File Details Report for the property. Very professional.

- A quick method is to find yourself on a map.

- OK, your property is designated historic. Now what?

- Contact the Florida State Historic Preservation Office at alayna.gould@dos.fl.gov. Ms. Gould is in the Architecture Preservation Services department and is one of the tax credit specialists. She/they will assign you a Case number, email you a Things To Do checklist and off you go!

Conclusion

Historic properties can be made more sustainable, energy-efficient, and resilient, improving their performance and use while also preserving their historic character. Doing so not only improves their efficiency and livability but helps to ensure their long-term preservation.

As with many grants and government programs, the smart move is to get everything lined up before you start investing and to keep excellent records throughout the period of rehab and for the 5 years after the rehab is complete.

Given the historic nature of Key West architrecture, residential and commercial, pursuing this opportunity seems a no-brainer. I asked Florida's SHPO if any property owner in Key West had taken advantage of this opportunity and the answer was - ONE property, in Bahama Village over 10 years ago but NONE since!

- Harris School namesake - Jeptha Vining Harris.

- Harris School today - Abandoned

__________________________________________________________________________________________