Shown below are the before and after the bubble Big Picture of the seven most popular

types of single family homes in Old Town Key West.

I’ve been keeping track of Old Town sales since 2000. The graphs shown here are for single family homes that are mostly west of White St., The Meadows, Old Town, Truman Annex and Casa Marina areas but not Sunset Key. I kept it simple. The homes I review below contain no half baths and I include just those bed/bath combinations that have enough sales to provide a credible trend over time. This is the activity in Old Town thru 1 April 2012:

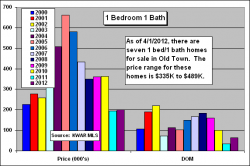

One 1bed/1bath single family home has sold in Key West, a major decline in the “under $500K” category. In part this is due to the shortage of small homes in Old Town, both actually and that those purchased since 2004 have been remodeled into 2 bed homes.

It should be noted that, for all properties herein reviewed, Days on Market (DOM) is an inexact number as many homes have been on and off the market over the past 3-4 years. I can find no correlation between DOM and Prices other than a well priced property will sell more quickly and often at a higher price.

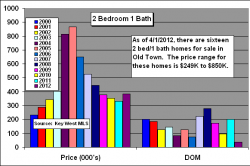

Two, 2bed/1bath single family homes have sold in Old Town. The average sales price of $383,000 is 15% more than 2011 which was 6% less than 2010. This average sales price is the first increase since 2005, though the decline in 2011 was the least and reflects a bottoming of the market as short sales and foreclosures dry up. The price per square foot of $501 was a 36% increase over 2011 which was a 4% decrease from 2010. The 2bed/1bath category has averaged nineteen sales per year since 2008 so only two sales thus far is worrisome.

Historically, 2bed/1bath have been the 3rd biggest seller in Old Town. Sales have fallen from the peak years of 2002-05 when older homes were snapped up for renovation and flip.

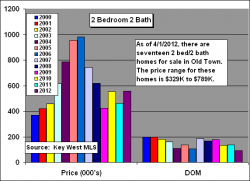

Seven 2bed/2bath single family homes have sold in Old Town. The average sales price of $558,000 is 21% more than 2011 which was 7% less than 2010. Also too, price per square foot of $508 was 27% more than 2011 and parallels the increased sales price. The graphic shows pricing strength since 2010; however number of sales since 2009 has fallen. 2009 had 39 sales, 2010 had 26 sales, 2011 had 18 sales. Seven sales thus far in 2012, and seventeen for sale in a reasonably tight price range, are both positive signs for the year ahead.

Historically, 2bed/2bath homes have been the biggest seller in Old Town.

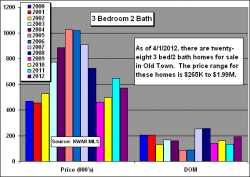

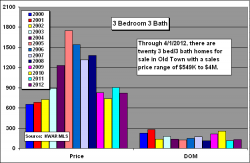

Four 3bed/2bath single family homes have sold in Old Town. The average sales price of $572,000 is 11% less than 2011 which was 30% more than 2010. This is the only house category to have shownyear over year price increases in 2010 and 2011. There are twenty-eight 3bed/2bath homes for sale and the price range of over $1.5M from lowest priced to highest is significant. Clearly this category of home is difficult to define. Four sales do not make a trend but after 91 days into the year, and after averaging 19 sales per year since 2007, sales in 2012 could be tough for what has historically been the 2nd biggest seller in Old Town. Nine 3bed/3bath homes have sold in Old Town making them the winners thus far in 2012. The average sales price of $823,000 is 9% less than 2011 which was 23% more than 2010. The sale price increase in 2011 was the first increase since 2008.

Unlike the two-year run up in prices for 3bed/2bath homes, prices here are stabilizing though well off the peaks of 2005-06. There are twenty homes in the pipeline, priced from $549K to $4M. Traditionally homes in this category have commanded price premiums. The number of homes sold and their prices fell thru 2010 as buyers delayed purchases, but returned in 2011 with cash and 4% mortgages.

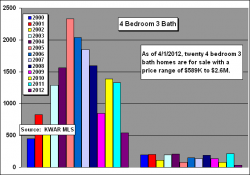

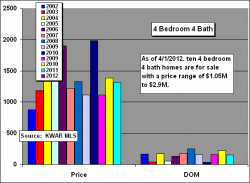

Sales of 4bed homes are negligible with only one 4bed/3bath selling and zero 4bed/4bath homes having sold. With twenty and ten homes respectively in their sales pipelines, sales of 4bedroom homes for 2012 could be sluggish. Sales of these larger homes have a irradic past and buyers for them have not yet returned in force.

It is worth noting that sales over $1M have returned to Key West. Economic factors external to Key West, Boomers and foreign nationals have brought a measure of confidence to the plus $1M arena. It remains to be seen if that confidence will continue in the upper end of real estate.

Key West remains a mix and match of properties with locals and out-of-towners all looking and buying. These charts mostly point to stabilizing prices as inventory tightens, down 17% from March 2011, and Buyers and Sellers return to negotiating parity.

Still, I don’t think anyone would argue with you that the worst days of the Key West market are behind us.

Just ask anyone, cause there are a lot of experts in town.

If you have any comments, please contact me here.