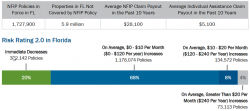

The FEMA National Flood Insurance Program (NFIP) Risk Rating 2.0 flood insurance program went into effect for new policies in October 2021 and for renewals from existing policy holders in April 2022. As with any major shift in policy, there was considerable concern about rising premiums and the fairness behind them. FEMA's data-based campaign to assure policy holders that premiums would not skyrocket had some positive effect but the naysayers kept up their complaints about not being able to scrutinize the modeling data, how do policy holders challenge premiums they deem unfair and the long held misunderstanding that Monroe County is paying more in premiums than they are receiving in claims. And so, are the actual premiums meeting projections?

How did we get here?

In December 2021 I wrote an article about the expectations and projections of Risk Rating 2.0 in Key West and Monroe County including links to ten previous articles I have written dating from January 2013 that track the evolution of NFIP flood policies and premiums.

Risk Rating 2.0 (RR 2.0) is not just a minor improvement, but a transformational leap forward. Risk Rating 2.0 does not use flood zones to determine flood risk. Risk Rating 2.0 enables FEMA to set premiums that are specific to the property, are significantly more fair and that justifies both premium increases and decreases.

FEMA Guidelines

Meanwhile FEMA RR 2.0 is maintaining and complying with existing statutes:

- Most rates do not increase more than 18% per year. (As determined when Congress passed the Homeowners Flood Insurance Affordability Act in 2014).

- FEMA will continue to offer premium discounts for pre-FIRM subsidized and newly mapped properties.

- Policyholders will still be able to transfer their discount to a new owner by assigning their flood insurance policy when their property changes ownership.

- Discounts to policyholders in communities who participate in the Community Rating System will continue.

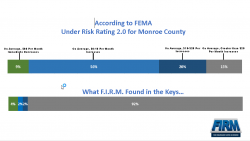

- In October 2020, Key West received a CRS Class 5 Rating which equates to a premium discount of 25% for the nearly 8000 NFIP policy holders in Key West.

- In April 2022, Unincorporated Monroe County received a CRS Class 3 Rating which means most of the nearly 14,400 NFIP policyholders in unincorporated Monroe County are expected to receive premium discounts of 35%. Of the 1,700 participating communities nationwide, only 14 communities rank Class 3 or better. Well done Monroe County Floodplain Management..

NFIP policies Monroe County

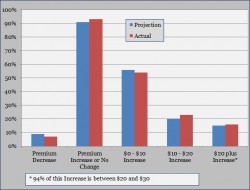

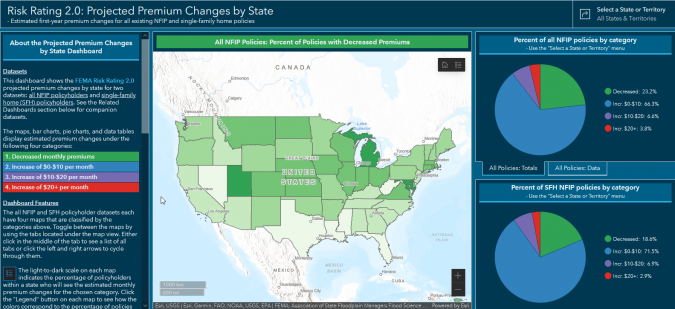

Prior to implementation of RR 2.0, FEMA projected that of Monroe County's approximately 30,800 total policies, 9% would see a rate decrease and 91% would see a rate increase. Five percent could have a rate decrease by more than $20 per month and 15% could have a rate increase by more than $20 per month. (Please see the graphic to the left).

Compare this with Miami/Dade County which has approximately 347,000 policy holders. Of these, 22% were projected to have a rate decrease and 78% a rate increase. Three percent were projected to have a rate decrease by more than $20 and 5% were projected to have a rate increase by more than $20 per month.

Were FEMA's projections for Monroe County accurate?

FEMA's projections were right on!

- Projection - 9% would see a premium decrease

- Actual - 7% are receiving a decrease

- Actual - 55% of policy holders are receiving either no change or a premium increase of less than $10 per month.

- Projection - 15% would see a premium increase of $20 per month or more

- Actual - 16% are receiving an increase of $20 per month or more Of this 16%, 94% are receiving an increase of between $20 and $30 per month.

FEMA has provided premium rate change data for every state and every county. If you would like to dig into the numbers yourself, the data for every county in Florida, County Breakdown, is here.

Conclusion

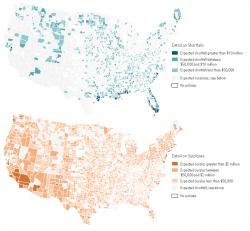

Is Risk Rating 2.0 the cure for decades of politically driven NFIP policies and premium mismanagement? Biggert-Waters 2012 (BW-12) wanted immediate 25% premium increases annually. Consumer uproar caused Congress in 2014 to negotiate BW-12 to a maximum of between 15% and 18% premium increases annually. Still, the fairness of premium distribution was very poor (see image at top of page). As of today, premium rates remain heavily subsidized, the national participation rate by flood probable property owners is inadequate and not enough lenders mandate and monitor that their mortgages are supported by flood insurance.

Up until now, flood zones were a reasonable fallback given the limits in (government) mapping techonology. As FEMA mapping technology achieves parity with the private sector, property specific premiums are becoming more viable; hence, Risk Rating 2.0.

Final step - premium fairness. What exactly is risk versus premium? Changing the mindset of "donor" status will not occur until subsidies are decreased, participation rate increases, property owners carry full actuarial responsibility and more private flood insurance companies enter the market in Florida and Monroe County. Hopefully, choice.will bring clarity.

If you have any comments or questions, please contact me here.

Good luck!

Additional Resources: