In July 2012 the Surface Transportation Bill (H.R. 4348) was signed. Inside this Bill was the Biggert-Waters Insurance Reform Act of 2012. This Act extended the National Flood Insurance Program through 2017. It also phased out subsidized rates for certain types of real estate, including investment and second homes. These properties will no longer receive reduced premiums. Annual premiums are allowed to increase by 25% per year until they achieve the full premium rate. This and other provisions are designed to save a program that is $18 billion debt and to avoid further disruption of US real estate markets.

The first thing I would do is call (John) Isaksen Insurance, 305.872.0097.

The Act brings several substantive changes to the program, including several that alter the way rates are calculated. There are two primary rate changes:

1. Higher Premiums for Buildings Below the Base Flood Elevation (BFE).

- Congress (via Biggert-Waters) instructed FEMA to stop giving premium discounts to properties that are below the BFE, even if they were up to code when built.

2. Pre-FIRM and Grandfathered Rates Phased-Out

In the past, many structures were allowed to keep their original flood-risk rating, even when conditions and improved understanding had changed. Such as:

- The building was built before 1975 or before the community (governing jurisdiction) received its first Flood Insurance Rate Map (FIRM). These buildings have often been insured at Pre-FIRM rates, unless the owner opts out of this option.

- The building was built Post-FIRM, in compliance with a FIRM, but a more recent FIRM shows the building to be at greater risk of flooding. These buildings had been grandfathered administratively, and were allowed to keep the rate-class (flood zone and building elevation relative to BFE) that applied at the time of construction.

A more detailed review of these changes can be viewed here.

The biggest changes comes in Premium Rate Structure Reforms:

- Phases out subsidies for second homes, business properties, severe repetitive loss properties, or substantially improved/damaged properties. Rates for these properties will increase by 25 percent per year until premiums meet the full actuarial cost.

- Requires that any premiums for a new flood insurance policy for a property not currently covered must be based on actuarial rates.

- Raises the annual cap on premium rate increases for any property (except those subject to the phase-out) from 10 percent to 20 percent.

- Requires FEMA to allow policyholders that are not required to have their premiums escrowed every month with their lender to pay their premiums in installments. FEMA currently requires a single annual premium payment.

According to Isaksen Insurance, "FEMA defines a non-principal/non-primary residence as a building that will not be lived in by the insured or the insured's spouse for at least 80% of the 365 days following the policy effective date".

So what can you do about all this?

The only thing you can really do is call your insurance agent and ask him/her what changes there will be to your premium.

Second to that, you can look up your Flood Zone and at least know that. It's easy but it takes a couple of steps.

1. Find your RE number. Also called the Parcel ID, the RE number is needed to locate your property on Monroe County Flood Maps.

- Go to www.mcpafl.org. (Monroe County Property Appraisal Florida).

- Choose Property Search.

- Choose Real Property Search.

- Type in property address or last name. Parcel ID is what you want. (the eight digits before the dash). Write it down and go to the next step.

2. With your RE number, go to www.monroecounty-fl.gov.

- Select Divisions

- Scroll down to Growth Management

- Scroll over to Floodplain Management

- Scroll over to Flood Zone Maps Online

- Check FEMA, Overview, Topography, MCPA and either 2006 or 2009 Orthophotography depending if the structure was built before or after 2006; i.e. if after 2006 then select 2009.

- Select Find RE Number. Insert eight digit RE number and click Find.

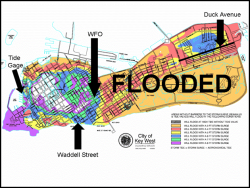

- This will take you to an overhead view of the property and show what type Flood Zone you are in.

In lieu of all this you can call Mary Wingate, Flood Management, at 305.289.2866 to find out your Flood Zone classification. Ultimately you should call your Flood Insurance agent to find out what, if any, rate increases you can expect.