Housing stocks from builders like Lennar (LEN) and D.R.Horton (DHI) to renovators like Lumber Liquidators (LL) and Home Depot (HD) have shown solid gains since the housing market bottomed in 2010. They reflect the value of the actual housing asset. Companies also in the housing arena like insurers and mortgage servicers provide investment opportunities that don’t exactly parallel the actual housing asset; providing the investor with an opportunity to play real estate but be somewhat sheltered from it’s erratic ups and downs. Insurers and mortgage servicers with their broader business plans maintain steady revenue streams, buffering themselves from market swings.

Let's look at two leading Insurers

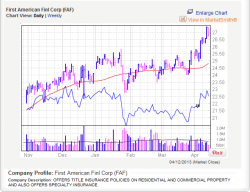

First American Financial (FAF) operates in two segments; title insurance for residential and commercial property and property and casualty insurance. FAF pretty much leads the pack, having hit an all-time high in increasing volume of $27.40 on April 11. 4th Qtr 2012 profits were reported up 73% to 85 cents per share from 4th Qtr 2011. While not yet released, 1st Qtr 2013 earnings are estimated rising 38% with sales up and topping $1B.

FAF profits from new home purchases and refinancings (refis). It holds 27% of the U.S. title market. Refis comprise 65% of FAF's business. For a more indepth of FAF, please click here to read my initial report on FAF in January 2013.

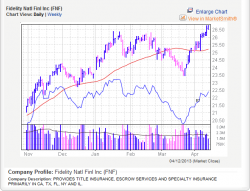

Fidelity National Financial (FNF) and its subsidiaries provide title insurance, escrow services and speciality insurance in 49 state plus DC, Guam, Mexico, Puerto Rico, the U.S. Virgin Islands and Canada. FNF is the largest title insurance company in the US, issuing approximately 37% of residential and commercial title insurance policies. Among the companies operating within FNF are; Chicago Title, Alamo Title, Commonwealth and Fidelity National Title.

FNF had 4th Qtr 2012 earnings per share of 66 cents with full year 2012 earnings of $2.68 per share versus $1.66 for 2011. Commercial title business generated nearly $143 million in revenue, by far the strongest commercial quarter in the history of the company. For the full year 2012, commercial title revenue was nearly $412 million, an increase of 13% versus 2011.

Mortgage service providers

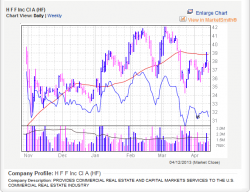

HFF, Inc (HF) is one of the leading and largest full-service commercial real estate financial intermediaries in the U.S. HF recorded its highest quarterly revenue, $97.3M, for the 4th Qtr of 2012, an increase of $21.4M, or approximately 28% more than the 4th Qtr of 2011. Among the properties it has closed or provided financing for in 2013 are; The Breakers in Denver, three Omni hotels in TX and IL, The Communities of Ascot Glen in Willowbrook, IL and in San Francisco a Class-A tower at 100 Spear St.

HF carries 0% debt and has a three year earnings per share growth rate of 138%.

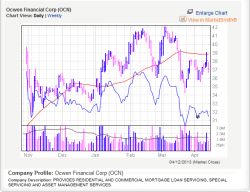

Ocwen Financial (OCN) through its subsidiaries, engages in the servicing and origination of mortgage loans in the US and international. OCN has a market cap of $5.14 billion. The company has a P/E ratio of 28.9, above the S&P 500 P/E ratio of 17.7.

Ocwen is growing as major banks leave the mortgage servicing business. Acquisitions since 2011 have fueled growth now and for the future. Among these are; Liberty Home Equity Solutions which will provide access to reverse mortgages and seniors, Homeward Residential Holdings Inc., an integrated mortgage firm with prime lending and mortgage servicing operations, Saxon Mortgage Services Inc. and Litton Loan Servicing.

Tree.com (TREE) provides online lending services via Lendingtree.com. Of the three stocks shown here it clearly has the cleanest price profile with the stock rising 147% over the past 12 months.

The net income for 1st Qtr 2013 increased 71.7% over 1st Qtr 2012 from $1.18M to $2.03M. The gross profit margin is 94%, yet that is less than the same period last year and the net profit margin of 8.47% trails the industry average. Earnings per share is up in 2012 and 2013 but TREE continues to lose money, losing 24 cents in 2012 versus losing $4.52 in 2011. For 2013, the market expects an improvement in earnings to 66 cents.

Conclusion

Insurers and Mortgage servicers provide an opportunity to participate in the resurgence in residential and commercial real estate without actually holding interest in a company that builds, owns or operates real estate.

If you have any comments or questions, please contact me here.

Thanks and Good Luck!

Additional resources: