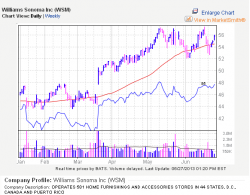

Rising home prices allows home owners who have been playing it close to the vest to use that new found equity to make improvements to their property. Some choose physical or cosmetic improvements inside or out, including outdoor spaces and landscaping. Traditional winners are Home Depot (HD), Fortune Brands Home & Security (FBHS), Valspar (VAR), Generac (GNRC), Beacon Roofing Supply (BECN), etc. The home furnishing industry, led by Restoration Hardware (RH) and Pier One (PIR) is also reaping rewards. Here’s a snapshot of another winner - Williams Sonoma (WSM):

San Francisco based Williams-Sonoma, Inc. (WSM) is a specialty retailer of high-quality products for the home. These products represent eight distinct merchandise strategies

- Williams-Sonoma (cookware and wedding registry),

- Pottery Barn (furniture and wedding registry),

- Pottery Barn Kids (kids’ furniture and baby registry),

- PBteen (girls’ bedding and boys’ bedding),

- West Elm (modern furniture and room decor),

- Williams-Sonoma Home (luxury furniture and decorative accessories),

- Rejuvenation (lighting and hardware) and

- Mark and Graham (personalized gifts and gifts for the home)

Williams Sonoma (WSM) has become a start to stop corporation for furnishings, kitchen gear and foodies, catering to shoppers with superior e-tailing and 580+ stores in the US, Canada, U.K., Australia and Puerto Rico.

Williams-Sonoma (WSM) raised its dividend in March and now has one of the highest yields in its industry.

The annualized dividend yield is above 2% based on its recent share prices. The company paid a quarterly dividend of 10 cents in 2007 and then 22 cents until March 19, 2013 when the dividend was raised to 31 cents a share. Also last March, WSM set a $750 million stock buyback to be executed between 2013 and 2016

Williams-Sonoma's three-year EPS growth rate is 22%, with a range of 8% to 21% per quarter since June 2011.

New brands and spinoffs have played a key role in the company's growth. The company says 75% of revenue comes from brands such as Pottery Barn and West Elm.

Pottery Barn

Pottery Barn was established in 1950 and was part of Gap, Inc until bought by WSM in 1986. Pottery Barn provides stylish well constructed furniture and accessories for every room inside and outside your home. The colorful mix and match options allow every room to reflect your personality and comfort.

A successful arm of Pottery Barn is Pottery Barn Kids which includes a separate kid-focused blog and Summer Reading Challenge through PBS Kids.

West Elm

West Elm was launched in 2002 in Brooklyn, NY. West Elm collaborates with independent artists and craft communities to create affordable statement pieces and seasonal collections. An increasing number of West Elm products are marked “West Elm Green” – a label that proudly indicates responsibly produced, organic, recycled, rapidly renewable, or non-toxic products. The West Elm assortment includes furniture, bedding, bathroom accessories, rugs, window textiles & hardware, lighting, decorative accessories, dining, kitchen products and gifts.

Conclusion

Many of this home related stocks are beyond a reasonable buy-in point so waiting for a pullback is probably your smartest investment option. If you are buying produce from these stores you're in luck as both brick and mortar and e-tail options can bring you style and savings.

A final note, equity is a good thing. Don't spend it just cause you have it.