Stocks, bonds, commodities, cash, real estate, insurance. The essential elements of a balanced portfolio. Long term growth plus cash flow. Managed risk within a steady reward. Rapidly retiring baby boomers in their 50's and early 60's and pre-retirement Gen X who are buying Old Town Key West real estate look to their purchase of an Old Town property as a means to strengthen their living portfolio. Steady appreciation of the value of the property plus cash flow from vacation rentals (optional) with marginal long term risk and a home to enjoy at their discretion. What is the 5, 10 and 15 year appreciation and estimated vacation rental cash flow on an Old Town Key West single family home? Let's take a look.

When do we begin

As with any fiscal analysis, the starting point is critical to the validity of the analysis. A blowout Quarter can make follow on success seem tepid. Beginning from the bottom of a trough makes even the dullest advances seem investment worthy.

The last down cycle for Key West real estate was 2005 - 2010. Hurricane Wilma and its flooding of the Florida Keys in October 2005 knocked the wind out an overheated and frothy market. The Old Town Key West area was marginally damaged by the flooding but graver damage was done. As did real estate prices nationwide, property values declined significantly. Average home values in Old Town Key West declined 50% with number of sales and sale price bottoms occuring in 2009 and 2010. Profit hungry investor/flippers who had placed minimum down from 2001 - 2005 in expectation of big, fast rewards were slammed. Many walked away, dragging the market with them.

However, since the bottom the market has moved inexorably upward. Number of annual sales have ebbed and flowed but prices have stayed the course - Up. The number of sales in 2018 exceeded both 2016 and 2017. 2019 sales topped 2018. In 2019 only two months had an average sales price of less than $1M. Average sales price per square foot for 2019 topped $819, 19% above the 5-year (2014 - 2018) average and 35% above 5 years ago (2014). Your average 1300 square foot Old Town Key West cottage sells for over $1M!

Opportunity Cost

Spending on one item automatically means you are not spending on another. Opportunity cost is the difference between what you did not invest in, minus what you did invest in, In truth, return on neither investment is known at the time of making the decision. Risk managment too plays an important role in the decision making process. Past performance in real estate is a pretty good indicator of future performance, in part because real estate is a long, open-ocean wave. Stocks, bonds and commodities for the most part can be sold and the proceeds placed into your account within seconds. Real estate can take weeks and months to sell - both a good and bad attribute.

What does the 5, 10 and 15 year market look like in Old Town?

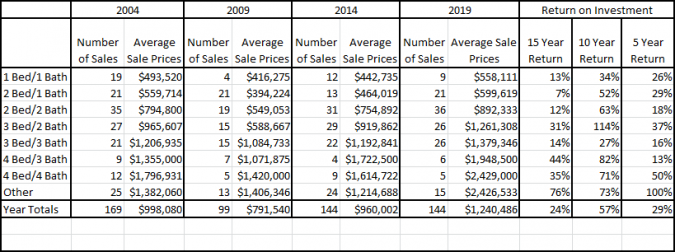

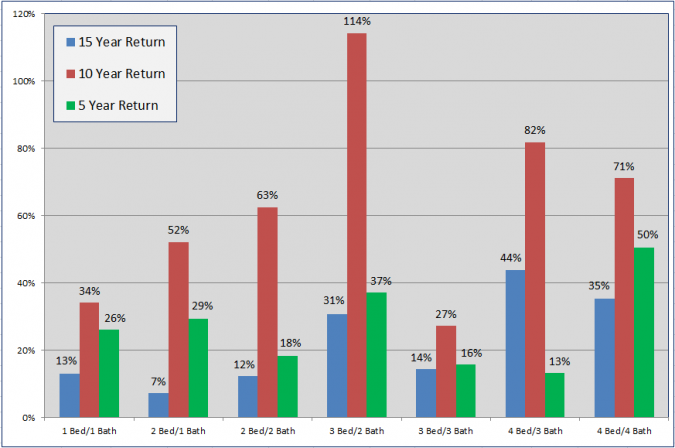

Enough talk. Let's look at Old Town single family home sales. From the above chart of Number of Sales and Average Sale prices in Old Town Key West you can see 2004, nearing the end of a 5-year run-up, 2009, nearing the end of a 5-year downturn, 2014 well into a multi-year recovery and 2019, nine plus years off the bottom. What do these sales and average sale price numbers tell us?

Note:

- Other is homes irregularly configured such as 3bed/1bath, 4bed/2bath and everything with 5 or more bedrooms.

- Year Totals is the sum of Number of Sales x Average Sales Prices divided by the total number of sales for the Year.

- Return on Investment is; for instance 15 Year Return, Year 2019 minus Year 2004 divided by Year 2004.

These numbers tell us that, to be sure, risk has its reward. Those brave enough to dive in during the 2009 - 2010 period have been rewarded with top returns. Yet, even 5 Year returns are acceptable, enhancing the maxim "Buy High and Sell Higher".

Since 2009, 2bed/2bath homes have been the #1 seller in Old Town with 321 sales. 3bed/2bath homes have been the #2 seller with 231 sales.

OK fine, what about income from my Old Town property?

Vacation Rental ROI

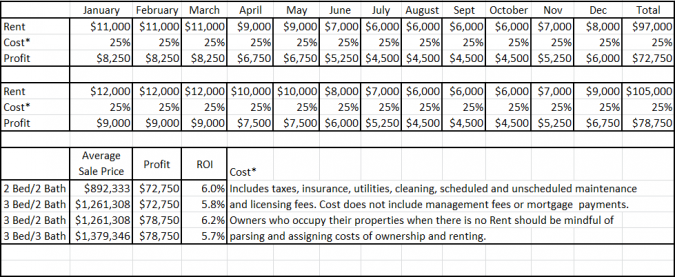

Figures shown above are fairly mid-market. I hear of rent rates both significantly higher and moderately lower. Also, the property owner has a choice of hiring any property manager they want or self managing their property. Generally speaking, a managed property will get to the above Gross rates quicker than a self managed property - at the cost of approximately 15% commission. A self managed property could take up to 24 months to acquire the return and referral business needed to generate the above Gross.

If you are buying property to use as a source of income, then ask your Realtor to create a credible pro forma worksheet showing you the estimated gross/net you could obtain. Your Realtor should also be able to provide options for property managers, or if you prefer to self manage; options for handyman and housekeeping, pool services, a/c repair, etc.

Where do Investors Search for Income?

Having an appreciating asset; stock, gold, real estate, etc., is great but you only pocket money when you sell it. Why not invest with a secondary benefit being receipt of income, or yield. A dividend. Granted, the underlying asset, the property, ultimately provides the greatest percentage of return but why not make some cash during ownership of the asset?

What are some investments that create a dividend, some cash flow? What were some of the average yields at the end of 2019? Savings accounts - 1.04%. Bond ETFs - 2.7%. Brokerage accounts - .0?%. S&P 500 average dividend - 1.83%. 10-year Treasuries - 1.73%. 30-year Treasuries - 2.2%. 3-year CDs - 2.25% Ho-hum. REITs - Many have dividends of 3%+ in addition to funds from operations. What about Key West vacation rentals as a source of income?

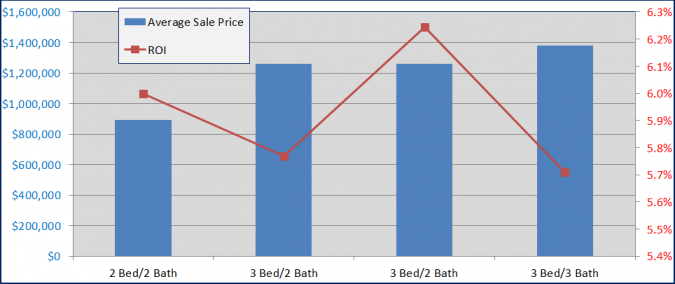

Looking at the above two graphics; if you are netting a steady $70K+ for a Return on Investment of 5% or more from your Key West single family home, while also using the property at your discretion, that's a Total Return of - Asset appreciation plus rental income plus the pleasure of living part time in Paradise. Not bad.

I agree, the cost of entry is high but be patient and build into the program as you would with any long term investment. Use a 203k to buy and fix up or roll into ever higher margin properties via multiple 1031 tax deferred exchanges.

Summary

To be sure, affluent, cash-rich buyers are a strong and steady presence in the Old Town market, averaging 52% of all sales over the past five years. These cash purchases occur from the $400K's to the multi-millions. Plus, there's many a Cash purchase that leads to another $100 - $300,000 in tailored upgrades. Such commitments, in many ways, form the bedrock of Old Town Key West real estate.

For the rest of us mortgage buyers, the committment to a $819 average per square foot purchase requires careful and gutsy analysis. Based on the above 15-year average sales data, single family homes in Old Town have durable growth prospects. Cash flow from seasonal rentals appears enduring, prospering without relying on macroeconomic certainties. Even in down years, people reward themselves with vacations. Key West B&B's and Guesthouses can provide 1st Class concierge treatment for those 3 - 5 day getaways. But for those able to get away for 10 - 30+ days, vacation rentals are their priority.

If you have any comments or questions, please contact me here.

Good luck!