The Masters' Exemption in the IRS tax code allows homeowners AND business owners to receive tax free rental income from their primary residence or vacation home as long as the rental period is fewer than 15 days. No muss. No fuss. In most cases the IRS doesn't even want to hear about it. No IRS hassles. No hassles from Tallahassee. No cranky local Code Enforcement officials or bothersome City or County Commissioner looking over your shoulder. No cap on the dollar value of the rent. This is a Great and totally above board way to optimize the cash flow of your property. Too legit to omit. Here's how.

_______________________________________________________________________________________

IRS tax code section 280A(g) Special Rule for Certain Rental Use is commonly referred to as the Masters' exemption after the Masters Tournament played annually at the Augusta National Golf Club in Augusta, GA.

Section 280A(g) states that “if a dwelling unit is used during the taxable year by the taxpayer as a residence and such dwelling unit is actually rented for less than 15 days during the taxable year, then … the income derived from such use for the taxable year shall not be included in the gross income.

Note that the definition does not say "primary residence" meaning the rule apples to any dwelling unit used during the year as a residence. A dwelling unit must have sleeping, eating and bathroom facilities; i.e. also an RV, boat, mobile home ...

What is the definition of "residence?"

A "residence" is any dwelling unit you use for personal purposes during the tax year for a number of days that’s more than whichever is greater:

- 14 days, or

- 10% of the total days you rent it to others; i.e.

- The dwellng unit is rented aperiodically throughout the year for 200 days. 10% is 20 days. If you stay at the dwelling unit for 21 days or more than you are using it as a "residence".

However, as the Masters' rule of tax free rental income max's out at less than 15 days; overwhelmingly, its use is for and by those who DO NOT rent out any residence(s) on a frequent basis.

For instance, your primary residence is your Homesteaded Key West home and you have a condo in Vail, Colorado that you visit on&off throughout the year. You rent the condo for less than 15 days during the year, usually 3 - 5 days at a time during periods of some special high-end event happening in Vail. The income is tax-free yet expenses are NOT deductible. ANY rental amount is authorized as long as that rental amount is within the ongoing market rate. Keep local advertizements, marketing promotions and rental solicitations as proof of "market rate".

What about renting to a business?

Suppose your business partners live in different states. Once a quarter they stay at any residence of yours to strategize about the next quarter's P&L. Your business pays you rent. Renting your residence to the business allows you to claim a deduction at the business level and exclude it from your personal income. Additionally, renting a residence of yours to a business NOT of yours will allow you to deduct the expense and exclude the rental income from your taxable income. It’s much cheaper to rent your residence than to pay for a hotel conference room or restaurant for the same use. Keep records of all communications and documentation.

Any business rental should be formally approved by the business and included in that business’s corporate books.This rule applies to both personal and business rentals, as long as the residence is not otherwise used for business purposes; home office, business storage ...

Conclusion

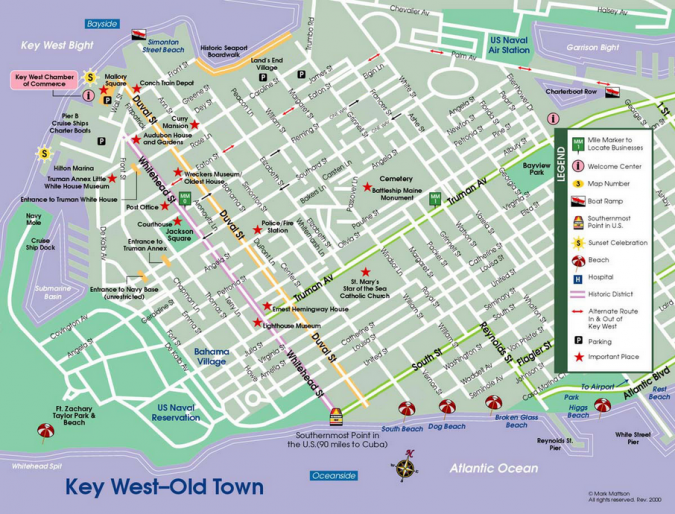

The City of Key West requires that all property owners who intend to rent their property in a non-transient manner; that is, for periods of time no more than 30 days at a time, must have and display a Business Tax Receipt (BTR) - Property Rental (Non-Transient). The annual fee is $22.05. Even if you intend to rent for less than 15 total days during the year, such a BTR is required. Call Licensing at 305.809.3955.

If you have any comments or questions, please contact me here.

Good luck.

Additional Resources: