You have owned a three-story, six unit apartment building in your city for 20+ years. You have recently decided to sell your family home and move out of your high tax northern state to a warmer climate, low tax state. You’ll take advantage of the $500,000 deduction for a married couple to offset the equity you’ve made in your home but you’re not sure what to do with your apartments. You don’t want to be an absentee owner; but, if you sell them there’ll be a whopper of a capital gains tax.

Why not exchange the apartments for investment property in your new town - and PAY NO CAPITAL GAINS TAXES in the process. Why not perform a 1031 Tax Deferred Exchange, increase the net worth of your holdings and defer capital gains taxes until it is in your best interest.

What is a 1031 (10-31) Tax Deferred Exchange?

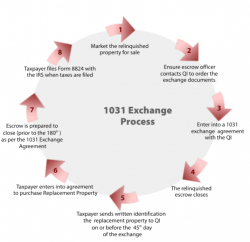

Simply stated a 1031 Tax Deferred Exchange is the sale of one piece of investment property (relinquished) and the purchase of a new (replacement) piece of investment property where the gains of the sale are used entirely in the purchase of the replacement property. Between the date of the sale and the date of the purchase, these gains are held entirely by a third party Qualified Intermediary (QI). Since the seller never realizes any actual "gains" or profits into their pocket, the capital gains tax on the sale is deferred. Forever even.

In 2000 there were less than 110,000 1031 Tax Deferred Exchanges nationwide. By 2005, rapidly rising property values caused that number to increase to almost 300,000. In 2013, as a result of falling home values, foreclosures and short sales, rental property has retained if not increased in value. This recent trend, along with presently rising real estate values, means the number of 1031 Tax Defered Exchanges are likely to rise. It also means your apartment building is going to cost you a bundle in capital gains taxes - unless you perform a 1031 Tax Deferred Exchange.

Timing is Critical

The "exchange" of properties, relinquishing the old and buying a replacement, must happen within a set period of time. First, within the first 45 calendar days following the sale of the relinquished property, the replacement property must be identified. More than one potential replacement property can be identified as long as you satisfy one of these rules:

- The Three-Property Rule - Up to three properties can be listed regardless of their market values. All identified properties are not required to be purchased to satisfy the exchange; only the amount needed to satisfy the value requirement; i.e. the price of the replacement property(s) must be greater than the relinquished property(s).

- The 200% Rule - Any number of properties can be listed as long as the aggregate fair market value of all replacement properties does not exceed 200% of the aggregate Fair Market Value (FMV) of all of the relinquished properties as of the initial transfer date. All identified properties are not required to be purchased to satisfy the exchange; only the amount needed to satisfy the value requirement.

- The 95% Rule - Any number of replacement properties if the fair market value of the properties actually received by the end of the exchange period is at least 95% of the aggregate FMV of all the potential replacement properties identified. In other words, 95% (or all) of the properties identified must be purchased or the entire exchange is invalid.

Second, within 180 calendar days of the closing of the sale of the relinquished property, the closing of the sale of the replacement property must occur. If more than one property is relinquished then the 180 days begins on the closing sale date of the first property.

If either of the 45 day or 180 day milestones are missed the deal is off.

What about the Money?

In order for the seller to defer all capital gains taxes, the entire proceeds from the sale of the relinquished property(s) must be spent on buying the replacement property(s); hence, the replacement property(s) must be of equal or higher value than the relinquished property(s). A single property can be sold and multiple purchased, many can be sold and one purchased or one can be sold and one purchased, any combination as long as the value of the purchased property(s) is greater than the value of the sold.

If the replacement property(s) are of lesser value than the relinquished property(s) the monies left over are considered as "boot". The seller should use caution with regard to closing costs as non-transaction closing costs must be paid by the seller, not by the proceeds from the sale. Boot is taxed according to established capital gains rates.

Finally, the proceeds from the sale are never received by the seller. The proceeds from the sale MUST be held by a qualified intermediary (QI) such as Starker Services, Inc. (Starker was the first company to perform QI duties). In fact, the seller signs a written agreement with the QI to act as both seller of the relinquished property and buyer of the replacement property; thereby shielding the seller from tax consequences (boot notwithstanding). The QI establishes an escrow account to receive proceeds from sale and to use for the purchase. All deeding displays the true buyers and sellers.

I highly recommend Diane Rivera, Regional Manager for South Florida in Miami at dorivera1031@bellsouth.net.

Conclusion

In addition to a QI, seller should retain a Realtor and CPA familiar with 1031 Tax Deferred Exchanges. The basics are described above but there are areas requiring specialization such as:

- Can a second home be defined as investment property

- Can investment property become a second or primary home

- Making the 45 and 180 day milestones requires a diligent Realtor

- "Construction to suit" exchanges where replacement property is purchased yet requires improvements to equal/exceed the relinquished property

- The tax consequences of highly depreciated property

And finally, if you are exchanging cattle, the IRS says bulls can not be exchanged for cows. They ain't the same.

If you have any questions or comments please contact me here.

Good luck.

Additional resources: